Preparing you for all Financial Aspects of your Retirement

FINANCIAL PLANNING | INVESTMENT MANAGEMENT

We offer intensive, hands-on classes online as live webinars as well as at different colleges and universities located throughout the St. Louis metro area. All who attend one of our classes receive a free, no-obligation, in-depth retirement plan. Seating is limited so reserve your place early.

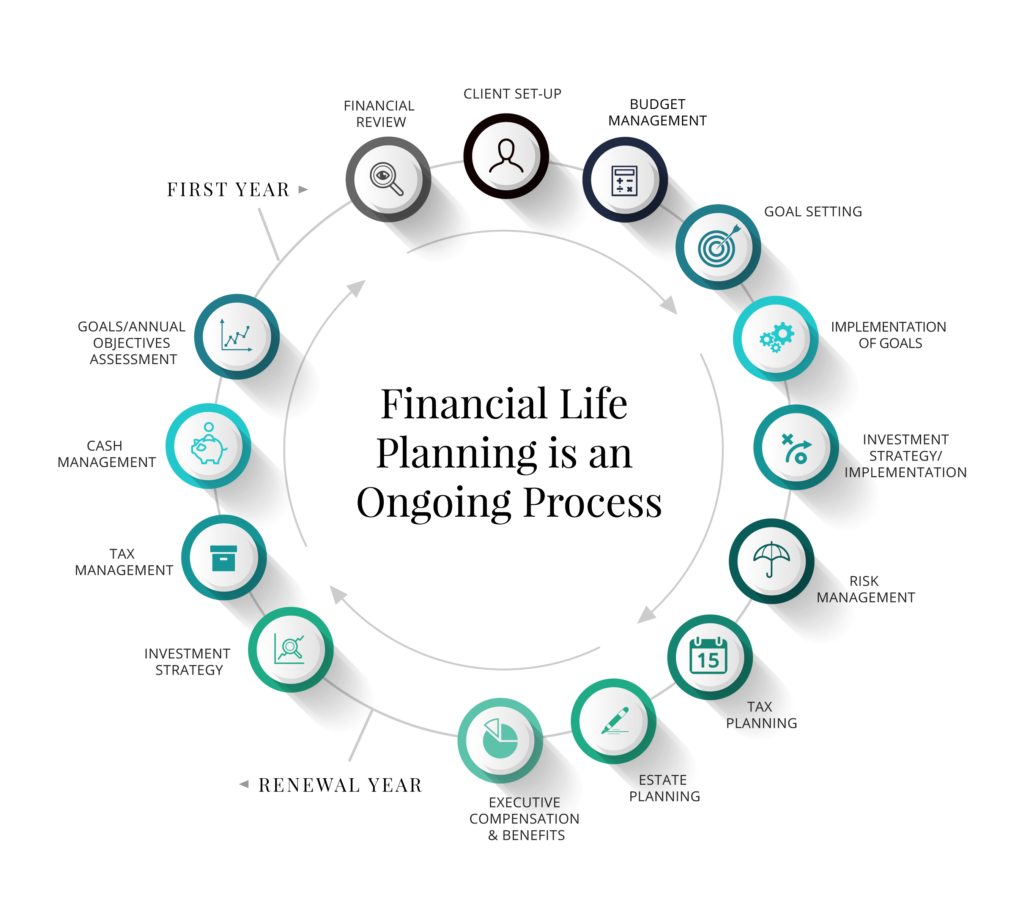

The most critical element to a successful retirement is your ability to have Income for Life. Our goal-based financial planning process is designed to help you obtain the income you need to attain the goals you set for your retirement. Assuredly, one of those goals is to stay retired even during the inevitable market fluctuations that are not uncommon to our financial markets.

At FTA, we have created our own proprietary investment strategies we call Private Wealth Strategies. Private Wealth Strategies are individually designed to address different specific objectives. We blend those strategies when building a client portfolio. The goal is to create a profile that is limits downside risk during periods of market fluctuations while also allowing for growth opportunities.

Education | The first step towards planning your retirement is education. We offer an intensive, hands-on retirement planning class at different universities located throughout the St. Louis metropolitan area1. Everyone who attends one of our classes is eligible to receive a free, no-obligation, in-depth retirement plan.

Fiduciary | We are fiduciaries. A fiduciary is defined as a person who holds a legal and ethical obligation to act prudently and in the best interests of another person. Make sure that your retirement planning is in the hands of a fiduciary.

As an investment adviser, we are a fiduciary, which means we have two fundamental duties — a duty of care and a duty of loyalty.

Under our duty of care, we’re required to provide investment advice in the best interest of our clients based on their investment objectives.

Under our duty of loyalty, we have to eliminate, mitigate, or make full and fair disclosure of all conflicts of interest which might incline us —

consciously or unconsciously—to render advice which is not disinterested such that a client can provide informed consent to the potential conflict.

We also have an obligation to act with utmost good faith and not to mislead clients or prospective clients.

As a fiduciary, we treat these duties with the utmost importance, as do the regulators who regulate us.

Make sure your retirement planning is someone who adheres to these responsibilities.

Planning | A successful retirement is best enabled by one important factor: Income for Life.

Investments | Our motto: Losses Hurt You More than Gains Help YouTM